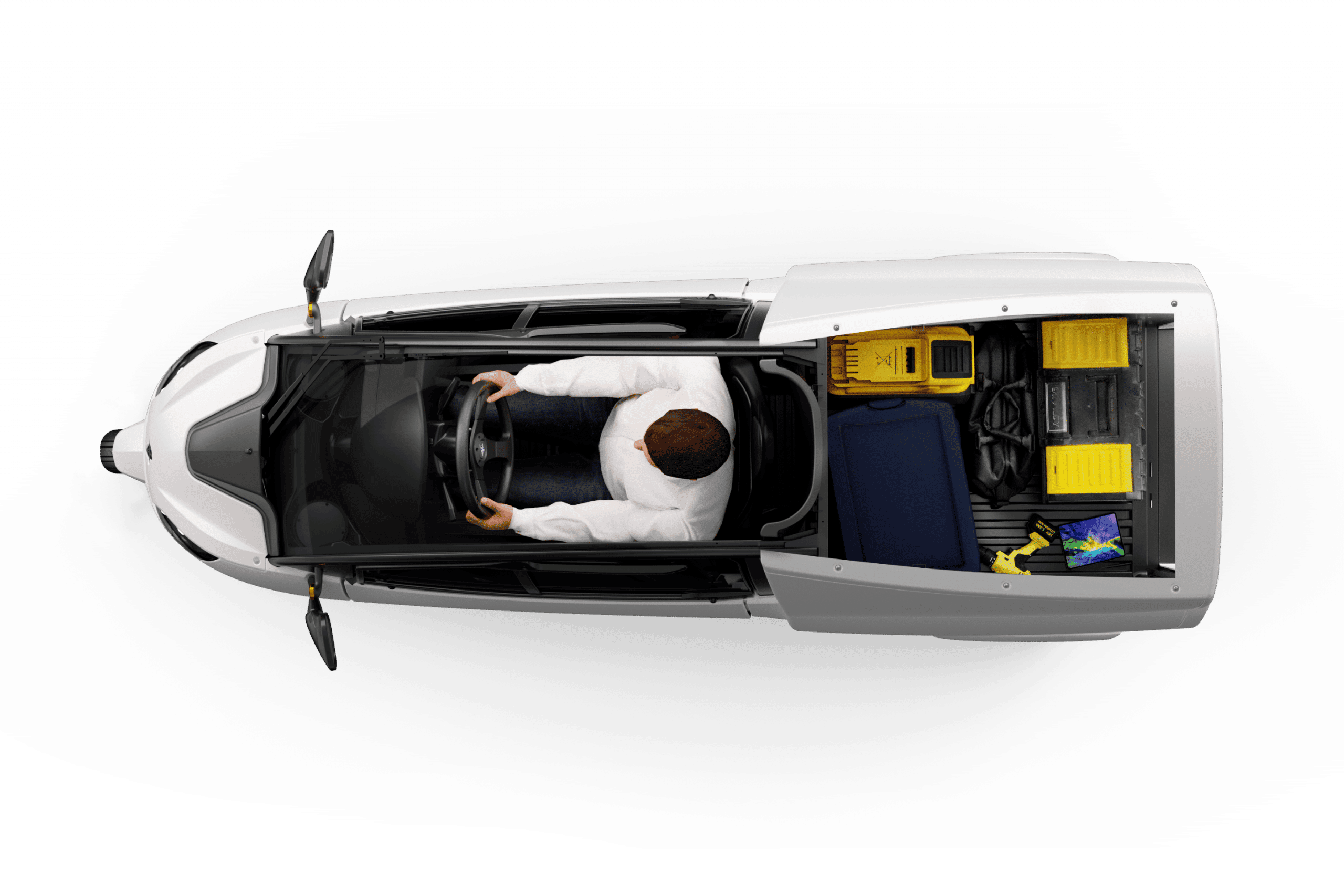

Low cost, less pollution and high efficiency with all your business trips.

Personal consultation

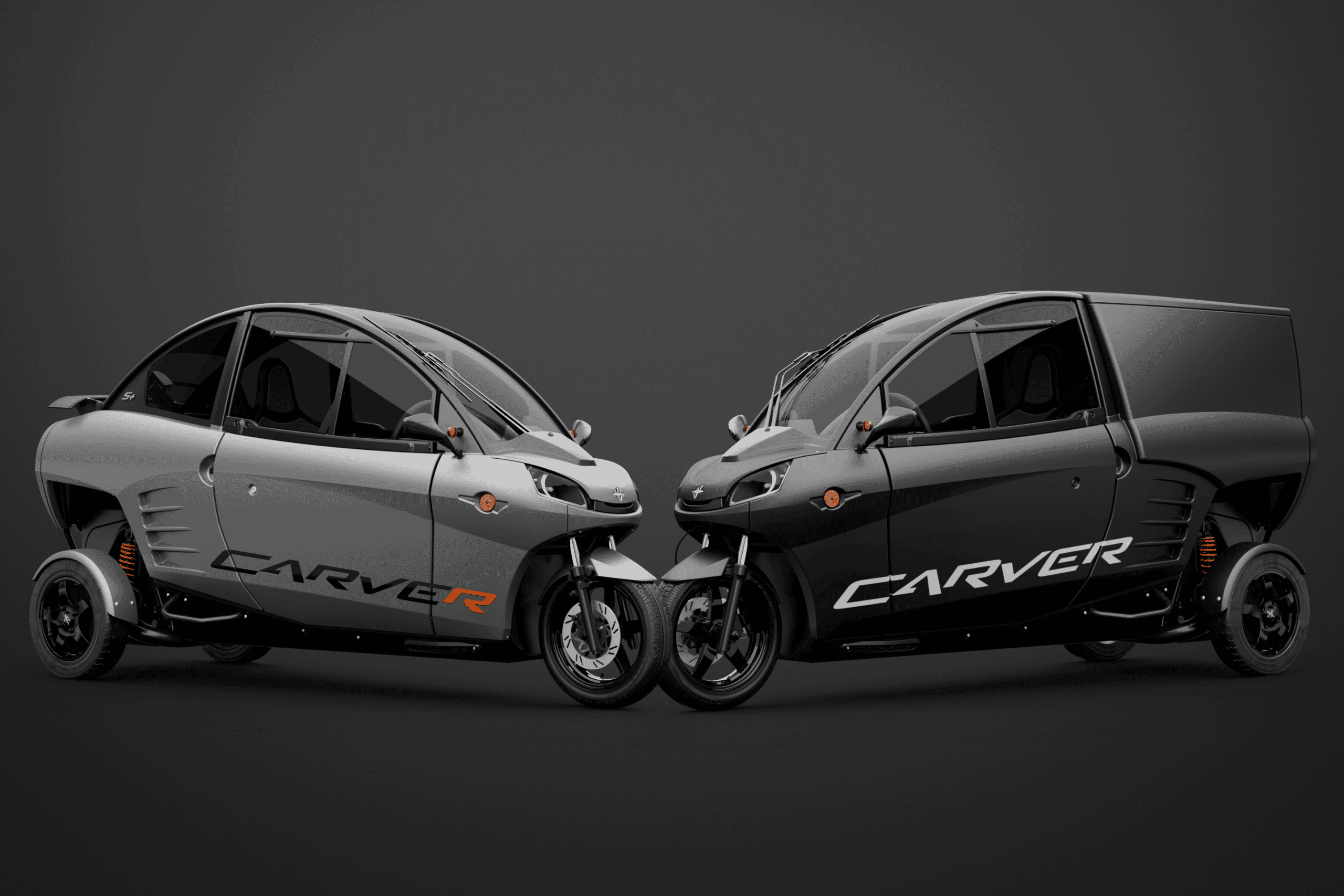

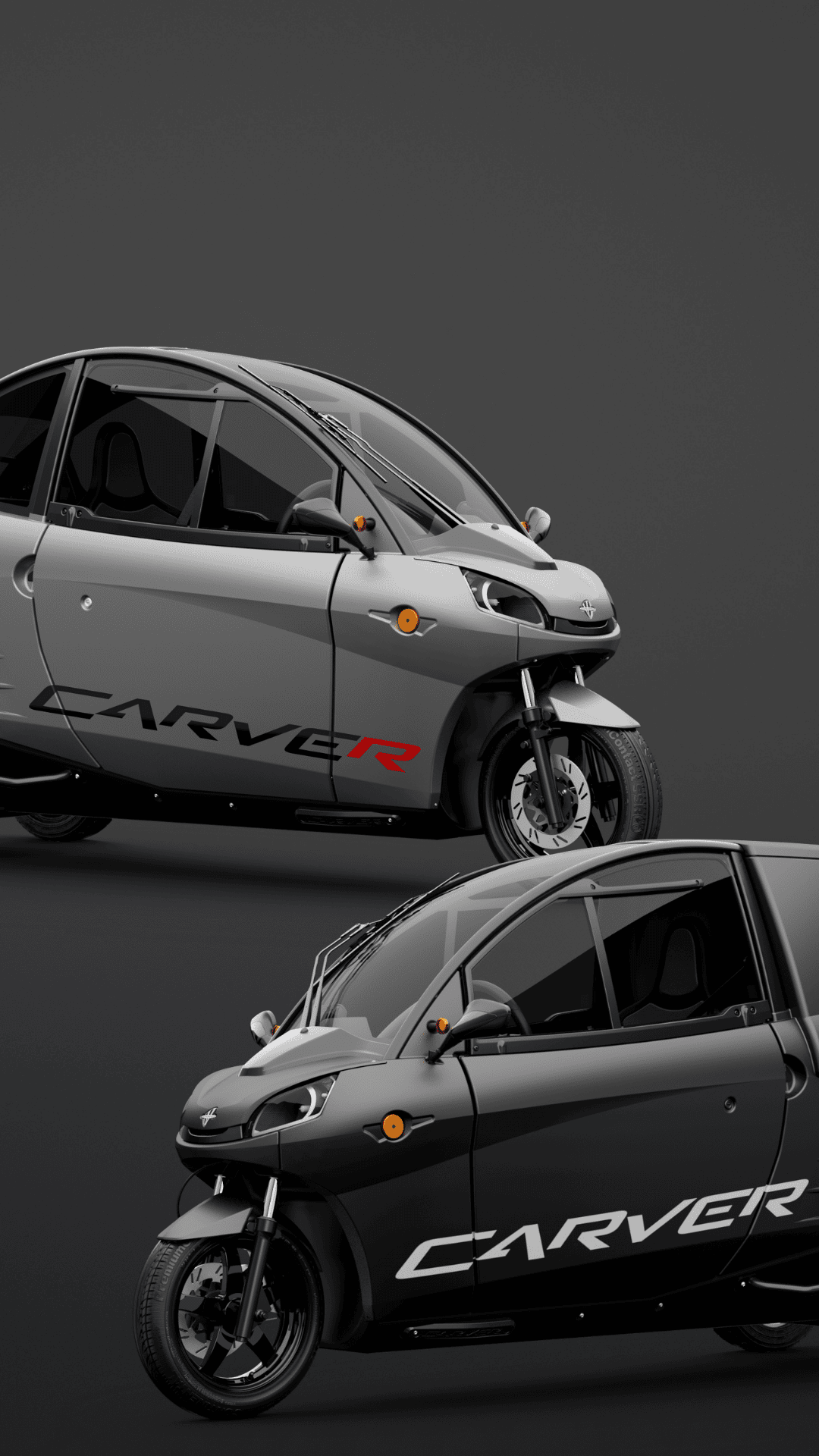

The best for your business

Do you doubt whether the Carver or Carver Cargo is the best fit for your company? Or would you like to know more about all the possibilities? Then contact us by means of a business consultation.

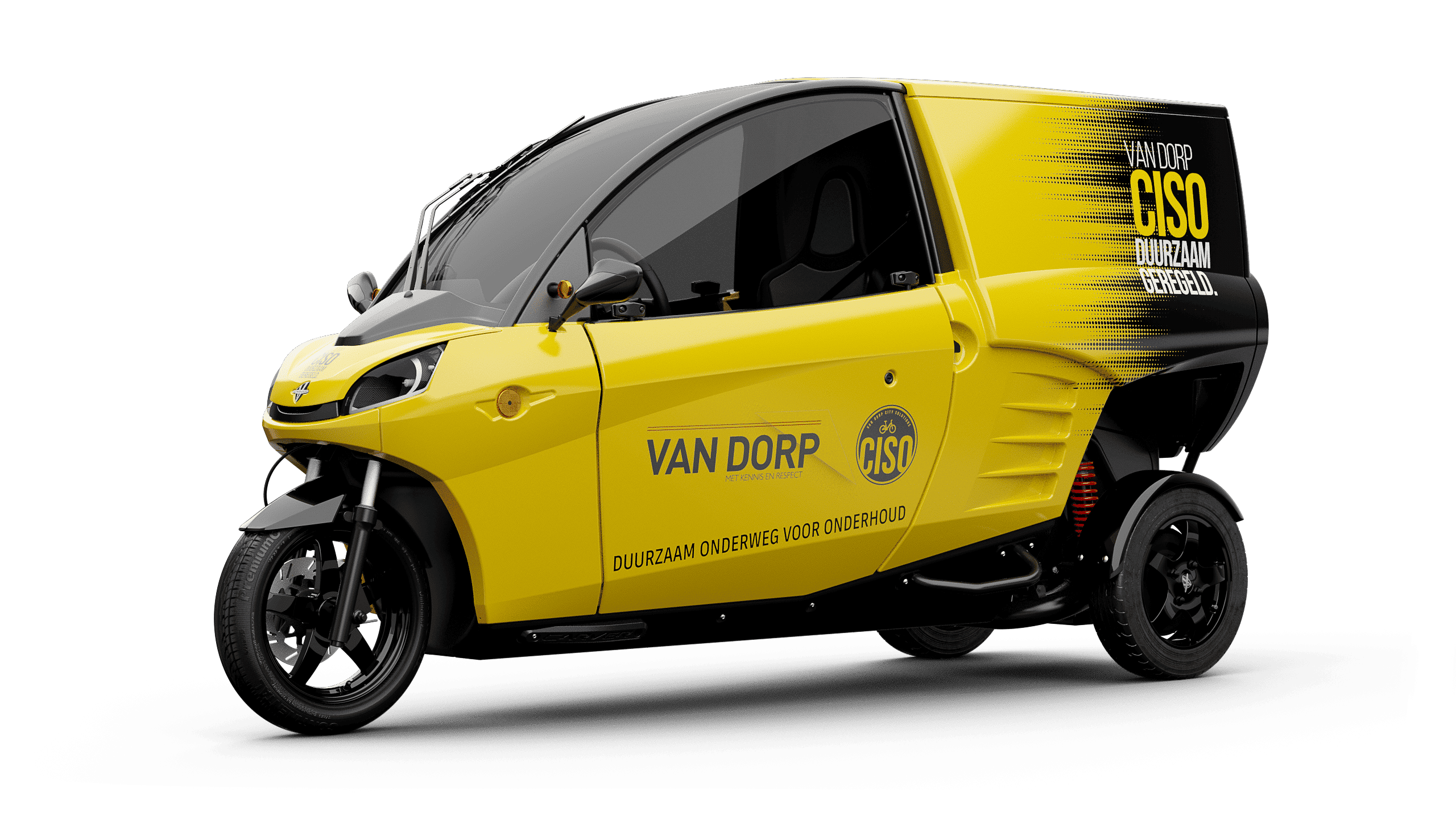

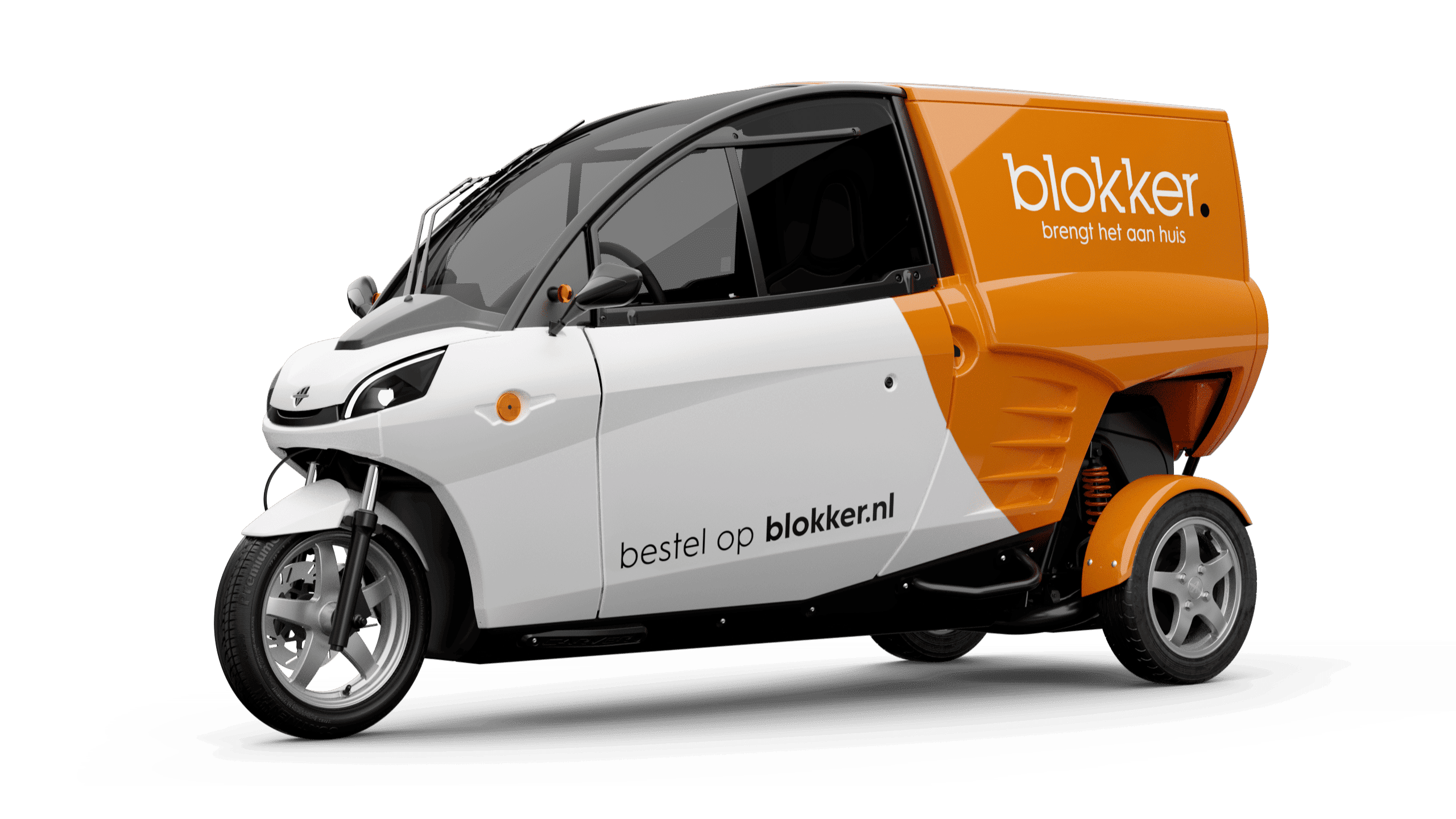

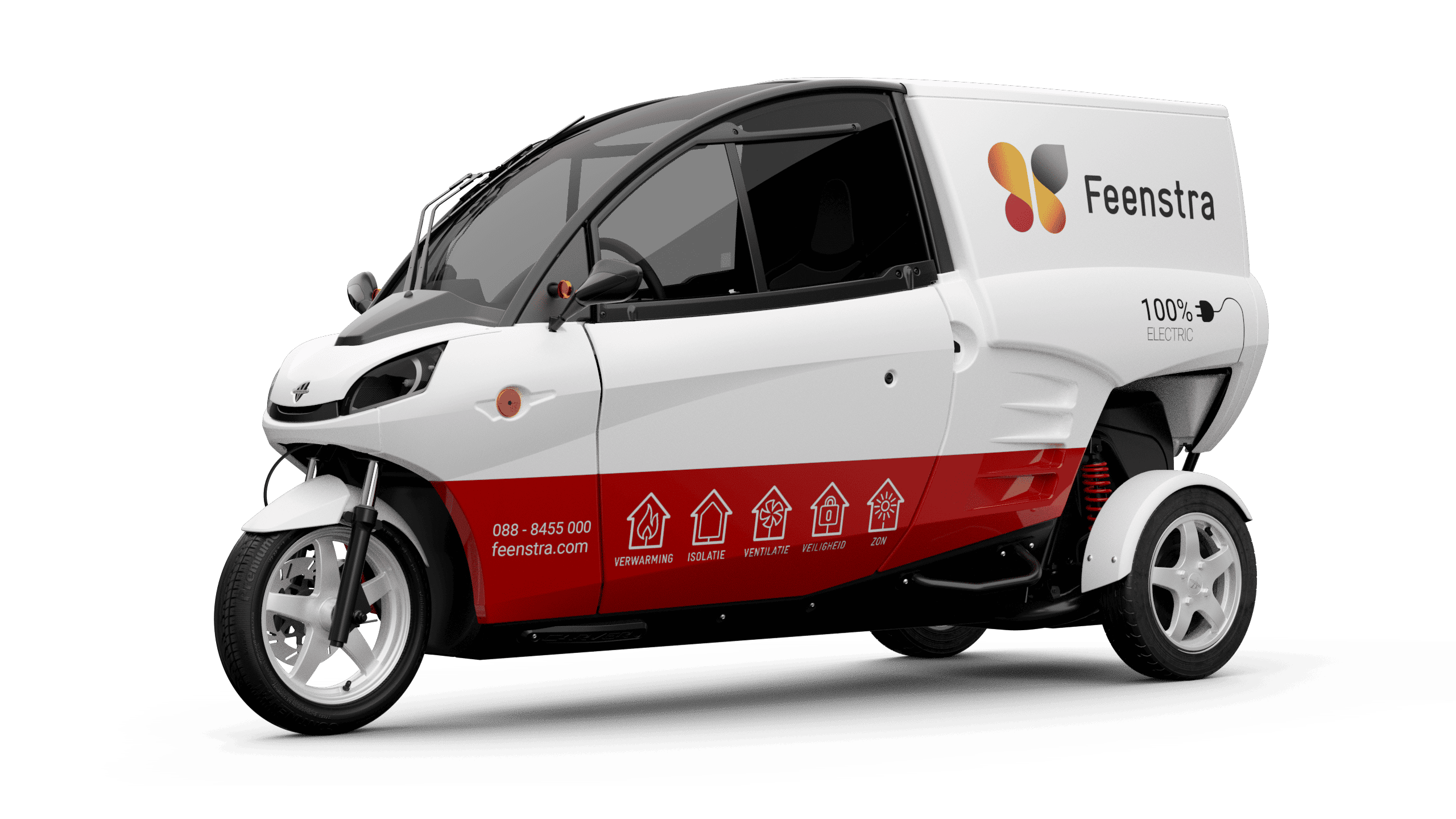

The Carver as a driving billboard

1 June 2022Using your vehicle as an advertising tool? That's the perfect combination for many companies. The Carvers and Carver Cargoes are available in different colors, but nothing is better than a vehicle in your own corporate identity.

Read more

Personalize

Own corporate identity

Check out Carvers from companies that have gone before you.

FAQ

What leasing options are available for the Carver?

You can lease a Carver commercially with financial and operational leases.

Which type of driver’s licence do I need?

The Carver Base and R+ are classified as a moped, which means that you can drive the Carver in the Netherlands with your scooter driving licence (AM). A car or motorcycle license (A or B) is also sufficient. For the Carver S+ you need a motorcycle driving license (A) or car driving license (B) from before January 18, 2013.

Where am I allowed to drive the Carver?

The rules of the road depend on whether your Carver is registered as a microcar (on the registration plate) or a three-wheeled motor vehicle.

Place on the road for moped (Base and R+)

Even though the moped is legally a moped, the moped belongs on the road. This also applies to provincial roads. Maximum speed on the roadway for a moped is 45km/h. For more information about where you are allowed to drive with a moped and tips for winding routes, we recommend that you check out the website Kronkelroutes.nl.

Place on the road for three-wheeled motorized vehicles (S+)

As a three-wheeled motor vehicle you drive both inside and outside built-up areas on the carriageway where cars drive.

Where am I allowed to park my Carver?

A disabled vehicle (Carver Base & R+) may not park on the pavement. Parking is allowed along the road in regular parking spaces. The parking rules for normal cars also apply to the Carver. For a three-wheeled motor vehicle (Carver S+), this varies by municipality.

Where can I insure my Carver?

With the operational lease your Carver is automatically insured. With financial lease you will have to insure the Carver yourself.

Where can I get service?

It is possible to get maintenance at one of our service points: https://carver.earth/en/service/

Discover the endless possibilities for your business and stop by one of our Carver locations.